Since mid-September, the market performance of anode materials has been mediocre. End-user new energy vehicle companies and downstream battery companies have continued to clear their inventories, and their willingness to stock up has gradually weakened. They purchase anode materials based on actual production conditions. The shipment volume of anode companies has declined month-on-month, and Due to the obvious intention of downstream companies to reduce costs and increase efficiency, actual negotiations are mostly focused on lowering prices, and the actual transaction price of anode materials has been under pressure. As of December 28, 2023, the reference price of China’s lithium battery anode materials market is 35,298 yuan/ton, which is 35,298 yuan/ton, which is higher than the previous price. At the beginning of the quarter, the mainstream price of Baichuan Yingfu’s high-end anode materials was reduced by 3,452 yuan/ton, or 8.91%. The mainstream price of Baichuan Yingfu’s high-end anode materials was 54,000-65,000 yuan/ton, the mainstream price of mid-end anode materials was 26,000-34,000 yuan/ton, and the mainstream price of low-end anode materials was 1.5- 20,000 yuan/ton.

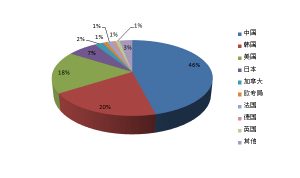

From the perspective of industry concentration, the CR4 industry concentration rate of China’s lithium battery anode materials industry is expected to be 66.5% in 2023, a slight decrease from 2022. According to statistics from Longzhong Information, there are currently more than 90 anode production companies, and less than 15 anode companies monthly ship more than 1,000 tons, accounting for more than 80% of the market share of the entire industry, while the remaining more than 80 companies will “rob” the remaining approximately 20 %market.

According to statistics from Longzhong Information, the production capacity of the anode material industry in 2023 is 3.9875 million tons. The average capacity utilization rate of the entire industry is less than 50%. The production capacity is difficult to digest. The price of anode materials is expected to drop further.

From the perspective of industrial barriers:

Technical barriers: From a technical perspective, the production process of anode materials is complex, the research and development cycle is long, and quality control is difficult. Production companies must have high application technology strength and production experience accumulation, which requires high technical levels and batch volumes. Preparation capabilities; at the same time, the needs of downstream lithium-ion battery manufacturers are relatively diversified, so anode material manufacturers are also constantly investing in R&D and technological innovation, focusing on improving and improving production processes and production efficiency to meet customized product needs. Therefore, there are high technical barriers in the anode material industry.

Capital barriers: From a financial perspective, the anode material industry has relatively high R&D investment and fixed asset investment; at the same time, due to the customized needs of downstream manufacturers, the production processes and products of each anode material manufacturer are highly customized, and the products are highly customized from the investment. The cycle from R&D to mass production is long, which places higher demands on financial strength and creates higher financial barriers.

Channel barriers: Due to the importance of anode materials in the production of lithium-ion batteries, lithium-ion battery manufacturers usually need to go through strict and complex testing procedures such as small trials, pilot trials, large trials, and small batches to select anode material suppliers. These procedures The cost is high and time-consuming, so once the supplier is determined, it will not be easy to change. At the same time, during the cooperation process, the customized processes and products formed by anode material suppliers based on the needs of lithium-ion battery manufacturers have further enhanced customer stickiness. Therefore, the list of anode material suppliers for lithium-ion battery manufacturers is usually relatively stable, and newly entered It is difficult for manufacturers to establish sales channels in a short period of time, so there are high channel barriers.

Supply side:

The power and energy storage market is not as good as expected, and towards the end of the year, the industry has once again entered the destocking stage. The downstream demand for anode materials has weakened. Since the fourth quarter, the output of anode materials has declined, and the enthusiasm of enterprises for production has declined. The operating rate of anode enterprises has declined again. In addition, in 12 In August, Henan was affected by environmental protection control and anode companies reduced production, and Sichuan was affected by heavy pollution weather warnings. Most small and medium-sized companies were suspended, and large companies were less affected.

The total output from January to November 2023 is approximately 1.2097 million tons, an increase of 25.46% compared with the same period in 2022. Among them, the operating rate of the anode material market in November 2023 was 47.71%, a decrease of 6.18% from the previous month. The output of anode materials in November 2023 was 126,000 tons.

In terms of cost:

Graphitization: The anode graphitization market is well supplied, and anode companies are accelerating the construction of integrated production capacity, resulting in a decrease in the share of orders received by graphitization foundry companies. Moreover, as most anode material companies clear their inventories at the end of the year, the demand for anode graphitization decreases, and supply and demand Under the condition of imbalance, the overall capacity utilization rate of the negative electrode graphitization industry is less than 50%, the production capacity is difficult to absorb, and the price of graphitization processing is constantly being compressed. It is currently close to the cost line. As of December 28, 2023, graphitization processing The mainstream transaction price of the cost is 9,000-11,000 yuan/ton. Some downstream anode material companies offer low prices, around 8,000 yuan/ton. The cost of negative electrode graphitization processing using Acheson crucible furnace is 10,000-12,000 yuan/ton. The cost of negative electrode graphitization processing in a box-type furnace is 8,000-9,500 yuan/ton, and the processing cost of negative electrode graphitization using an internal string furnace is 13,500-14,500 yuan/ton.

Petroleum coke:

The low-sulfur petroleum coke market is not trading well. Currently, terminals are mainly focusing on digesting inventory and purchasing urgent needs. The start-up situation of anode material companies continues to decline. After the coke price has been continuously reduced, bearish sentiment in the downstream has increased, and the low-sulfur coke market is generally relatively passive. , as of December 28, 2023, the average price of petroleum coke 1# is 2,410 yuan/ton; the average price of petroleum coke 2# is 2,130 yuan/ton; the average price of petroleum coke 3# is 2,005 yuan/ton.

Supply side:

Petroleum coke import ships arrived at the port intensively in December. The cost of sponge coke was inverted. Traders’ shipping sentiment was average, and the port’s petroleum coke inventory rose overall. In the first half of December, rain and snow in the north affected logistics. The supply of locally refined medium-sulfur petroleum coke was relatively tight, and downstream demand still existed. In the second half of December, medium-sulfur petroleum coke shipments were under pressure, and refineries cut prices for shipments.

Demand side:

The market for silicon metal rose in December. The fundamentals of silicon metal in December were in a weak state of supply and demand. The supply side continued to shrink, mainly due to environmental protection load restrictions in the north and low inventories of silicon plants in Xinjiang. The southwest region officially entered the dry season, and the operating rate remained stable. low position. The current procurement demand for petroleum coke from metallic silicon is acceptable, supporting the petroleum coke market.

Mainland refineries have delayed coking market starts to maintain a high position. Except for the temporary shutdown and adjustment of output of individual units, other units have maintained full capacity operations. Currently, companies are sorting out profits well, and the possibility of a sharp decline in market starts in the short term is small. In addition, imported cargoes are arriving at the port one after another, and the cargo holders are considering that the current import cost is upside down, and the overall willingness to ship is not strong. In addition, the downstream market demand is generally followed, and the port inventory is slowly destocked. At present, towards the end of the year, the demand in the terminal downstream market has improved slightly, which has led to an improvement in the shipment situation of the petroleum coke market to a certain extent. As the price of petroleum coke continues to fall, the production profits of some downstream industries have improved, and the downstream market has just needed Consumption is stable, and some refineries are actively reducing prices and releasing inventory. Taken together, some downstream companies are quite motivated to stock up before the holiday at the end of the year. Under the influence of stable demand consumption, the short-term market price is expected to be stable and good. In the later period, it is necessary to pay close attention to the operation of on-site equipment and the situation of downstream stocking before the holiday.

Needle coke:

At the end of the year, some companies sold at low prices in order to achieve full-year sales targets and relieve inventory pressure. Needle coke prices continued to fall under pressure during the month, and trading was weak. The price dropped by 200-600 yuan/ton. As of December 26, Baichuan The market price range of Yingfu’s domestic needle coke is 4,700-5,300 yuan/ton for raw coke and 6,500-8,800 yuan/ton for cooked coke; the mainstream transaction price of imported oil-based needle coke is 450-1,250 US dollars/ton for raw coke and 950-1,700 yuan for cooked coke. USD/ton, the mainstream transaction price of imported coal-based needle coke for cooked coke is USD 600-850/ton.

Since the end of November, market prices have continued to fall, with a decline of 100-600 yuan/ton. As of December 15, Baichuan Yingfu China’s needle coke market price range is 6500-8800 yuan/ton for cooked coke and 4700-5300 yuan/ton for raw coke; the mainstream transaction price of imported oil-based needle coke is 450-1250 US dollars/ton for raw coke. , cooked coke is 950-1700 US dollars/ton, and the mainstream transaction price of imported coal-based needle coke is 600-850 US dollars/ton.

1. The market supply is sufficient, and the price of needle coke has dropped again and again.

In terms of oil-based needle coke, mainstream companies are producing normally, while some companies have stopped production or switched to petroleum coke production. Due to poor demand, most companies in the market have obvious intentions to control production and try their best to maintain production and sales. However, the early inventory has not been exhausted. , the market supply still maintains oversupply. In terms of coal-based needle coke, most companies have switched production or stopped production, but there are still stocks in the market for normal sales, and the overall supply is loose.

2. Graphite electrodes are cautious in accepting orders, and the purchasing status of needle coke is not good.

At present, some companies in the graphite electrode market are withdrawing funds at the end of the year to seize market share. They frequently ship at low prices, and the market transaction mentality is divided. Therefore, they are cautious about acquiring needle coke. There are fewer new orders in the cooked coke market, and more purchases are made from old customers. Mainly, at the same time, electrode companies have no expectation of stocking up near the end of the year, and the needle coke market is making wait-and-see inquiries, which has a negative impact on the negotiations.

Looking ahead, the market for oil-based needle coke is still not optimistic next year. Due to cost reduction requirements, anode factories prefer low-sulfur or even medium-high sulfur petroleum coke, and raw needle coke is mainly purchased for rigid needs. At the same time, needle coke companies are in a weak position in upstream and downstream price negotiations, and cost support also limits the price of raw coke products. It is expected that the price of oil-based needle coke raw coke will be weakly stable in January, or may decline slightly, while the actual output and operating rate are both expected to decrease.

Natural graphite:

At present, the domestic flake graphite market is slightly sluggish. In December, most of the flotation production lines in Luobei area of Heilongjiang Province have been shut down, and the production enthusiasm of the enterprises in production is not high. Due to the temperature, production is expected to be stopped one after another before the end of December; Major graphite processing companies in Jixi region maintain normal production, while many small and medium-sized enterprises have suspended production. The overall supply of domestic flake graphite has declined. However, due to lackluster downstream demand, spheroidized graphite and refractory companies have mostly maintained cautious procurement. Therefore, there is insufficient motivation to increase the price of flake graphite. The domestic graphite market is expected to continue to move forward steadily.